Read it,here.

Same with Indiana.

I wonder how many states have the “No Limiting HI Liability”?

Indiana

Kentucky

New Jursey

I don’t like the sounds of this…but it makes sense.

So if a wall has a crack in it you better refer a SEngineer every time?

I wonder if the HI contract had the part in it about

" in order to allocate risk and enable inspector to perform the inspection at the quoted fee"

or if the liablity was maybe 3 times the inspection fee would that give the HI something to lose and a reason to be diligent in his inspection?

Limiting of liability has been struck down in many States when it is tested in court. I know that it will not work in AL, LA, TX, MS, TN and IL. I’m sure limiting liability will not work in many other States as well. The only way it works is if it is written into the home inspectors license law.

It works in Missouri.

It will easily work in other states, as well, if it is properly worded in your contract. Simply give your client a choice between a limited liability inspection for your regular fee … and an unlimited liability inspection for a fee that will cover your expenses at bringing in electrical and structural engineers and allow fifteen days for the report. I charge $3,000.00 for an unlimited liability home inspection. On each contract, my client has declined his opportunity to select and pay for an unlimited liability inspection. Thus, he is bound by his choice as I am bound to provide the required service.

There is no opportunity for argument as to “confusing” language or customer’s intent or understanding when he has initialed on the contract that he “declines” the opportunity for unlimited liability and, instead, “accepts the limited liability” in place of the higher fee. It becomes clearly his negotiated choice and decision to purchase the liability amount that comes with the lower fee.

Scott writes:

Scott is not quite correct (InterNACHI members have already limited their liability to the cost of the inspection in TX, TN and IL, had it challenged by the plaintiff, and prevailed anyway)… and Jim is basically correct, although our experience is that you might not need to actually give your client the limitless liability option to limit liquidated damages to the cost of the inspection if you use InterNACHI’s contract, which reads in part:

Note ii and iii, which are similar to what Jim is talking about.

InterNACHI has spent nearly a million dollars and many years on producing, refining, and testing its legal documents. Use them: www.nachi.org/documents.htm You can have Uncle Bob (your families attorney) review them if you like, but it would take him years to catch up and so he and you, should always begin with InterNACHI’s legal documents as core drafts for any inspection agreements you need.

The problem is that most HI agreements limit the liability to the fee paid to the inspector. Many people will not like this statement but this is not considered a “fair condition” in many court sytems and as such is not considered an enforceable arm’s length agreement in many cases. In the end you end up with an agreement that is not enforceable. If it is considered a real and fair condition it is thus enforceable it is usually at minimum defendable.

Read the article carefully and you will understand what the judge is getting at. Let’s face it say you hired someone and they come to consult on an issue that could potentially have thousands of dollars of repercussions and they are only liable to what you paid which could be miniscule in comparison to the damage you could personally incur. It just doesn’t equate in the minds of most court systems and to be quite honest it doesn’t in mine either. I think HI’s should have a liability set at 2-5x the cost of the service showing the court that you truly and honestly carry a liability with the service and as such will not be negligent because of your potential liability concerns. Now take into consideration this is my personal opinion and each state is going to vary especially if you have a regulating body but here in MN we do not. I live by a few simple rules:

-

Make sure the client had ample time to review the agreement. Send it to them well in advance and make sure they sign before the service is rendered.

-

Have a limit of liability that is honestly fair to both parties and terms and conditions well laid out within the document

-

Review the information they signed again at the conclusion of the service and touch on main points and ask if they have questions. I usually review the limit of liability and the dispute resolution sections of my agreement.

4)** Make sure the client has the ability to have a copy of the inspection agreement**, either the option to print it out after signing it prior to the service or provide to them within the report.

These are items that I have personally gathered after carefully stepping away from my position as an HI and looking at what court cases have occured in the HI industry. In most cases the courts seem to not care about the agreement if they were not provided a copy, the limitations or conditions are ridiculous or you were just plain negligent. I think everyone in the industry should be doing their best to deter bad claims and to prevent working with poor clients or the “price shopper” I can tell you 9 times out of 10 if I have worked with a “price shopper” or negotiator that it ends up biting me in the butt down the road, so I know longer negotiate pricing or services. If someone wants to utilize me and my outstanding service so be it, if they want someone cheap, check out the yellow pages and start calling because it isn’t going to be me.

Obviously, this is my personal opinion and everyone should check with their states requirements and your individual attorney.

Nick that is good news, can you cite the case’s? I would like to read up on them, especially the ones on TN.

Scott,

One such case in Texas is Head -vs- US Inspects. On the attached document, read pg 2 starting with “Professional Services under DTPA”. I am not aware of any connection to INACHI however. I make no claim that this has not been further litigated nor overturned on higher appeal but I have not heard that to be the case. Sorry, it’s a pdf file but just a little too big to post directly so it’s in a .zip file.

Head vs US Inspect.zip (250 KB)

There are other little tweaks to your contract which will strengthen your agreement through a strategy similar to what Jim talks about and what I posted in post #6. For instance, in the first paragraph of InterNACHI’s inspection agreement, we reference the report as “the bargained-for report.”

All of these little tweaks help, and we’ve been making them for decades based on the cases inspectors have been involved in, across several countries, and over many years.

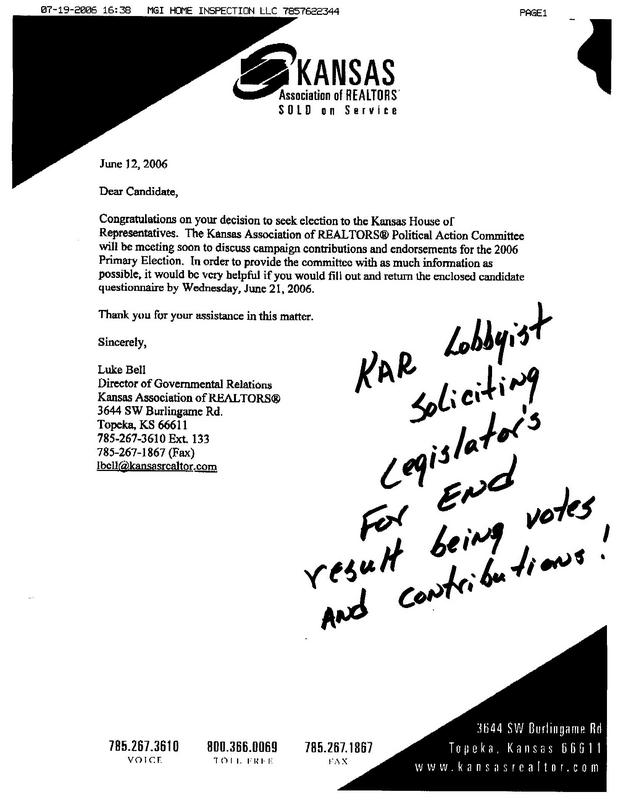

Three years ago I presented this letter MULTIPLE times to the Kansas Board of Realtors; the Kansas Legislation; and MANY media sources.

Anybody following the Kansas fiasco saw the good it did us.

Kansas only became a “fiasco” because stupid home inspectors funded ASSHI with their hard-earned membership dues. Sleep with dogs, ya get flies. Any dummy who opened their checkbook to ASSHI should now close their mouth. The ASSHI logo is the home inspection industry’s symbol of shame.

Any clause limiting the inspector’s liability in a home inspection contract in the state of MAssachusetts can cost the inspector his or her license.

Courts are beginning to carefully review the opressive nature of inspection agreements, and the sophistication of the clients when deciding whether to uphold contract provisions.

All companies and corporations do countless contracts everyday, all with limitations. Inspectors should be able to do this also. If states do not allow us to limit our contracts, this will open up countless lawsuits to the states, or to the lawmakers individually.

Just yesterday, as Joe Ferry can atest to, I had an issue with a VA lender, who wanted me to sign a statement on a termite inspection I did on a home. She wanted assurance that there was no structural damage. I refused. The sad thing about this is that on the NPMA-33 form that I used for this particular termite inspection is allowed for FHA/VA loans. They also wanted my termite license number, which was actually on the front of the form.

On the back, it stated that “…the report…nor is it a sturctural integrity report”. “…not qualify the inspector in damage evaluation…”

Front page line #3 for visible damage found, was not filled out by me.

All they wanted was to push off the liability onto me, when they cannot read their own report that was approved by them.

Lenders, agents, brokers are pushing liability onto us, and using everyway to do so. Those inspectors who are not listening to this message board, Nick, Joe Ferry, Joe Farsetta, Kenton Shepard, better listen, or just go ahead and give up your savings account, home, and business, to money hungry home owners.

We must write detailed reports, keep agreements current, not change the reports when asked, watch what we say and to whom, and stand by our reports no matter what. We also, as stated on another thread, when someone calls and asks you about the inspection you did at such and such address, to state that “I cannot discuss the results of the inspection without permission from my client”.

And, when the VA lender called me, from Virginia, I talked to an assistant to the lender. The lender would not talk to me. So, this assistant did. She wanted the statement from me to give to her boss. I told her the reasons why I refused, told her what the form stated, then she put me on hold. After several minutes, she came back on and said that “we understand” and that they would “investigate further” and hung up.

People are getting arrogant in this economy. Be careful, and tactful.

Kansas became a fiasco because we NEVER had a legislative hearing with more than 5 inspectors there to object to it AND mostly there were only 1-2 inspectors that PERSONALLY took the time to show up and stand up.

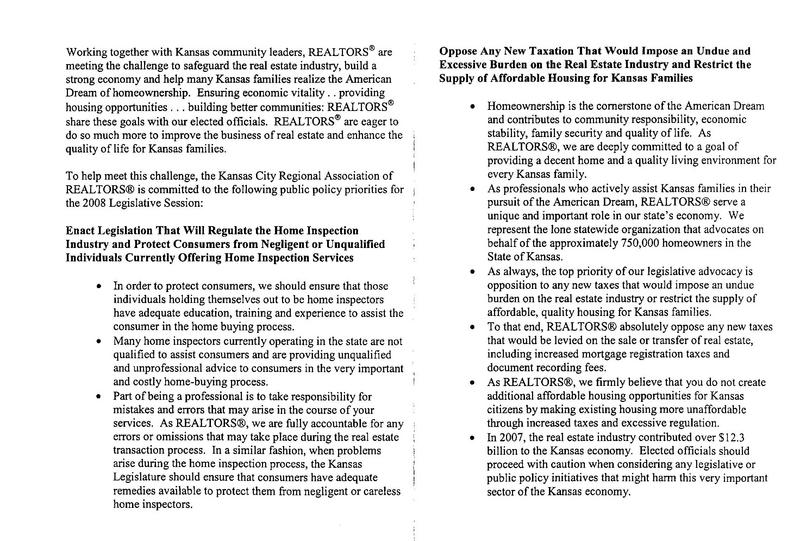

Kansas also became a fiasco because the state realtors association made a concentrated knock-down, dragout effort to solicit legislators promising votes and financial support in the November elections …

The head of the legislative Committee hearing the licensure Bill was a realtor; the ASHI inspectors in Wichita formed a group / called themselves the OFFICIAL state association for home inspectors - the realtors and the state attorneys group also designated this group AND 1 guy in their group as the OFFICIAL home inspector group / spokesman for Kansas.

They did not show up because they are mostly ASSHI. They did not show up because they did not want to interfere with their association’s “plans”.

I believe some lawmakers in Kansas are waking up to the fact that they messed up. In the SOP’s only a representitive number of items per room need to be checked; one outlet, one window, etc. Now, soft reports and cheap prices are the norm. This is what the agents wanted, and got through the effors of the KAR and the “other association”. The new SOP’s actually hurt the consumer, which is what most lawmakers did not want to happen. I look for a long fight in 2013 when the laws sunset. It will also be ugly in Missouri soon.

Now, after the new rules have been in play for a few months, some of the good professional agents in Kansas are complaining about the soft reports, and the problems that come with them. Mortgage companies are finding out also, and requiring a second inspection, all to compare the two reports, sometimes three. I recently had calls from Virgina VA office about this subject. As I stated in another thread a couple of years ago, since all state home inspection laws are creating havoc, it will not be long before the feds move in on our industry.

Good post, Gary.

The NPMA-33 is the inspectors best friend. It was created by the National Pest management Association, and is a blanket disclaimer. It is used by industry professionals for a reason.

Unfortunately, it requires signatures to be truly validated.

Depending on the legal venue, the courts may try and throw out some of its provisions in time.

We need to inspect smarter.

Joe, I agree 100%.

It is just that the new laws, agents, and even other inspectors will not let us inspect smart. Soft reports and cheap prices are now the norm, and allowed by law. This has pushed out us veteran inspectors, unless we stoop to the lowness of these new procedures. Here around KC, a company who does termite treatments is offering whole house mechanical, structural, and termite inspections for $249 on ANY size home.

Us veterans, such as Dan B. and I, know what is going on. But, we are starving and having to decide whether to make our house payment, or buy food.

And this will happen to our industry in every state. Having the best agreement will not get you any more business, and it will probably put you out of business, thanks to the new state laws and agents that want the soft reports. I feel sorry for the newbies, who are now performing these soft reports, because they will also be liable for all of the grief that will come with them.

As evident in the case history, even the judges can’t agree on how to handle issues with this industry. Both have decent arguments, one is that an agreement should not be interfered with and the other is that buyers deserve some recourse if something substantial is missed. If the states want to control this industry they need to first address how these common issues will be handled.

A smart inspector will report the possibility of leaky basements and the need for technical inspections. Chimneys are another one, every single chimney expert seems to find $4k to $15k worth of “improper construction” on every chimney.