Decided to look up this bitcoin stuff.

Looks like others are trying to copycat. Bitcoin, litecoin, feathercoin, infinatecoin, etc.

What will happen when there are a dozen different cryptocurrencies?

Scratch that. Looks like there are more than a dozen.

The “Inter” in InterNACHI stands for “International.” We already deal with dozens of currencies that (like the U.S. dollar) are mostly digital. You probably do too. No one pays for the inspection with a bag of paypals.

Hey guys, maybe we should start our own digital currency? We already have 32,400+ members in 65 countries we can trade with.

“InterCoin”

Reminds me of Tulipmania …

What was that like, Steve?

Jeff

Just watched talking heads on Fov video discuss Bitcoins and was surprised to see them valued higher than gold at the moment.

Basically one of the talking heads said try and go out to buy a gallon of milk at the store with one and see what happens.

Point two was that no government is going to allow competing currency so here comes China already banning them .

Watch out if you think this is a get rich scheme.

Nick,

Which one of these looks like a good deal?

Litecoin.

It all depends on how long you want to wait.

If you can wait 10 years, I’d advise that you buy gold.

If you can wait 4 years, I’d advise that you buy local tax lien certificates (they pay 10%-20% guaranteed) at a tax lien auction.

If you want to make money on your money this year and you are an inspector, I’d advise you get your CMI professional designation.

One should never invest more than 1% of their portfolio in anything. Well maybe with the exception of precious metal.

[RIGHT] [RIGHT] ](http://www.mondaq.com/default.asp?child_id=0&ncountry_id=0&topic_id=0&product_id=0)

United States: Bitcoin: Current US Regulatory Developments

Last Updated: November 28 2013

Article by Katten Muchin Rosenman’s Corporate Practice Group](http://www.mondaq.com/content/author.asp?article_id=277850&author_id=922924) and Katten Muchin Rosenman LLP’s Financial Services Practice Group

Katten Muchin Rosenman LLP](http://www.mondaq.com/content/company.asp?article_id=277850&company_id=1707)

In recent months Bitcoin has become a hot topic in the financial, regulatory and legal community and has received widespread attention from newspapers such as [FONT=Arial]The Wall Street Journal and The New York Times. Katten Muchin Rosenman LLP has been actively working on Bitcoin-related matters for the past year and has become a legal thought-leader in the area. As such, we would like to update our clients and friends on the current US regulatory developments regarding Bitcoin.[/FONT]

Bitcoin was introduced in 2009 and has produced a dynamic new economy composed of merchants, users, service providers and start-up enterprises. Over the past 12 months the value of bitcoins has appreciated by more than 6000 percent, and Bitcoin has achieved a current market capitalization of over $8 billion. In addition to gaining traction as a medium of exchange and a unit of account, Bitcoin has caught the attention of members of the financial industry, who are beginning to recognize Bitcoin for its potential as a short- and/or long-term investment opportunity. For example, the proposed Winklevoss Bitcoin Trust is designed to be the first exchange-traded fund product based in Bitcoin.1

Due to its potential to become a significant new financial payment mechanism, Bitcoin has attracted the attention of US federal and state—as well as international legislative and regulatory—bodies. On November 18 and 19, 2013, the US Senate Homeland Security and Governmental Affairs Committee and the Senate Banking Committee, respectively, held hearings (the “Hearings”) to discuss the risks and potential benefits of digital assets such as Bitcoin, which are also referred to as “virtual currencies.” Although the regulatory landscape surrounding digital assets has not been fully developed and is difficult to predict, the testimony provided at the Hearings reflected the following themes and suggested that US regulators do not intend to stifle digital assets:

[/RIGHT]

[/RIGHT]

- Digital assets have legitimate and beneficial uses that can foster innovation in a variety of ways, including micro-payments, enhanced security for retailers, and increased speed and cost efficiency in domestic and international payment systems.

- Existing federal laws, as well as law-enforcement, are capable of addressing the concerns relating to emerging digital assets, although developments are constantly being monitored in the areas of money laundering and other illicit uses.

- Various regulatory agencies have successfully applied the existing regulatory structure to prosecute large-scale money laundering operations that involved digital assets.

- Digital asset businesses and other industry participants that are willing to comply with applicable laws and regulations should be encouraged through a cooperative regulatory atmosphere. This sentiment was generally shared by the US Senators and panelists, in part to avoid discouraging Bitcoin entrepreneurship and driving it to countries with less stringent regulations.

Certain countries, including Germany and Canada, have emerged as “Bitcoin-friendly” jurisdictions through their favorable pronouncements regarding the regulation and treatment of Bitcoin. However, this advisory addresses the results of the Hearings and the current regulatory environment for Bitcoin under US federal and state laws.

Introduction to Bitcoin

Bitcoin is a type ofdigital asset which is based upon a peer-to-peer, decentralized computer-generated math-based and cryptographic protocol. Bitcoins may, among other things, be used to buy and sell goods or services, or as a unit of account.2 Bitcoins may be converted to fiat currency, such as US dollars or other national currencies based on then-current exchange rates.

Bitcoin shares certain characteristics with gold bullion in that each functions as a medium of exchange and is limited in supply (leading Bitcoin to be referred to as “Gold 2.0”). Approximately 12 million bitcoins currently exist and, based on the bitcoin formula, the maximum number of bitcoins that will ever exist is 21 million.

To date, no US legal body or regulator has officially determined that bitcoins are a currency, commodity, commodity money or security. However, as discussed below, the US Financial Crimes Enforcement Network (FinCEN), a bureau of the Department of the Treasury responsible for the federal regulation of currency market participants, has mandated that administrators and exchangers of all convertible digital assets, including Bitcoin, must register with FinCEN as money services businesses (MSBs) and comply with the requirements of both the Bank Secrecy Act of 1970 and the USA PATRIOT Act of 2001.

Digital assets, like Bitcoin, also provide a powerful financial tool for the transmission of money in both large and small quantities, in a domestic or international setting, for limited fees and with near real-time confirmation. Despite certain media representations to the contrary, the protocol and computer network that underlie Bitcoin (the “Bitcoin Network”) do not provide users with complete anonymity; rather, all Bitcoin transactions are recorded on the Bitcoin Network’s public ledger (known as the “Blockchain”), which is fully transparent. Bitcoin users are identified on the Blockchain by one or more pseudonyms in the form of “digital addresses,” of which a user may have many. Using existing technology and statistical analysis of the Blockchain, it is possible to track activity on the Bitcoin Network, thereby limiting the anonymity of Bitcoin users.

To date, Bitcoin is the most prominent digital asset with the largest user and merchant base and market capitalization. The technical features of Bitcoin that contributed to its relatively rapid adoption include:

- the Bitcoin Network’s open-source, decentralized nature and the capacity to quickly fix vulnerabilities or defects in the Bitcoin Network protocol through software updates;

- the Bitcoin Network’s cryptographically founded proof-of-work system that crowd-sources security and transaction verification to eliminate counterfeiting and prevent users from trying to repeatedly spend the same bitcoins (i.e., the “double spend” solution); and

- Bitcoin’s capacity to facilitate domestic and international transactions of any amount with minimal (or zero) transaction fees and near real-time transaction confirmation.

There are approximately 35 other digital assets being used today, many of which are based on protocols similar to or derived from Bitcoin. However, these “alt-coins” have achieved only a fraction of the market capitalization of Bitcoin in part due to Bitcoin’s status as a first mover in the digital asset space and the rapid, widespread adoption of Bitcoin due to its technological nature and minimal upfront costs.

Current State of Regulation

Money Service Business and Money Transmission Registration and Licensing

As of the time of this writing, FinCEN is the only US federal regulator to have released official guidance on the use of Bitcoin. In March 2013, FinCEN published interpretive guidance clarifying the application of the Bank Secrecy Act and the USA PATRIOT Act to Bitcoin and other convertible digital assets by stating that any administrator or exchanger of bitcoins (or other convertible digital asset) must be a registered MSB under FinCEN’s money transmitter regulations. The release indicated that individual users of bitcoins that are not operating a business would not be considered MSBs and therefore would not be required to register, report or perform recordkeeping. Such clarification also requires administrators or exchangers of bitcoins to comply with applicable state law and register with certain state regulatory agencies.

Furthermore, various state regulators, including the California Department of Financial Institutions, the Idaho Department of Financial Services and the New York Department of Financial Services, have followed FinCEN’s example and have issued interpretations or mandates requiring that Bitcoin exchanges and service providers register and/or seek licenses on a state level as money transmitters or MSBs.

Anti-Money Laundering and Other Requirements

Digital asset service providers that qualify as MSBs also are required to implement anti-money laundering, know-your-customer and financial information reporting policies and procedures in order to comply with various requirements under the Bank Secrecy Act and USA Patriot Act. Correspondingly, such service providers also may be subject to analogous requirements under similar state laws.

Absence of Clear Guidance

The absence of clear regulatory guidance concerning Bitcoin and other digital assets has generated substantial legal uncertainty for individuals and enterprises seeking to develop Bitcoin’s potential as a new financial tool. In May 2013, the General Accounting Office issued a report (the “GAO Report”) describing digital assets and urging the Internal Revenue Service (IRS) to issue guidance concerning the income tax treatment of digital assets (for example, whether gain from a sale of bitcoins is capital gain or ordinary income) under the Internal Revenue Code and the regulations thereunder. Thus far, the IRS has not issued any such guidance; however, at the Hearings, the Director of FinCEN indicated that the IRS was actively working on such guidance. Similarly, to date the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have not issued any guidance or interpretation concerning Bitcoin or any other digital asset.

The Federal Reserve System has indicated that it generally does not have the authority to regulate Bitcoin and other digital assets as they currently operate. Specifically, Federal Reserve System Chairman Ben Bernanke, in a statement submitted for one of the Hearings, stated that, in general, the Federal Reserve System “would only have authority to regulate a virtual currency product if it is issued by, or cleared or settled through, a banking organization that we supervise.” The Federal Reserve System does not have the authority to regulate Bitcoin because bitcoins are issued by and settled through the Bitcoin Network.

This lack of clear guidance has impacted the development of Bitcoin and other digital assets in the United States. In particular, uncertainty regarding Bitcoin’s legal classification and the MSB and money transmitter regulation of Bitcoin-related entities has resulted in a tenuous relationship between banking institutions and the Bitcoin economy, including start-up Bitcoin service providers. Clear guidance from federal and state regulators can lead to more certainty for both the banking and Bitcoin communities.

Legal Classification as an Asset

A fundamental question that remains unanswered is the legal classification of bitcoins for regulatory purposes. US federal regulators are aware that the asset classification of bitcoins is a central issue. The GAO Report did not formally classify bitcoins, but described them as akin to virtual property.

Therefore, the few findings in court cases and regulatory opinions involving the use of bitcoins vary in their determination of asset classification depending on the regulatory context. For example, the Federal Election Commission (FEC) and the Magistrate Judge in [FONT=Arial]SEC v. Trendon T. Shavers, et al. recently issued differing views on the possible legal classification of bitcoins. The FEC earlier this month proposed, but did not approve, a draft advisory opinion that would have permitted the use of bitcoins for in-kind contributions under the regulatory category of “anything of value,” which includes commodities, stock and equipment. The draft advisory opinion, noting the more narrow regulatory definition of “money” under election law, stated that bitcoins could not be accepted as a money contribution and would have to be converted to US dollars for deposit in a campaign account. In contrast, the Magistrate Judge stated that bitcoins “can be used as money” and possess attributes of a “currency or form of money.” [/FONT]

Currently no official guidance or determination exists from any US federal regulator that establishes whether bitcoins are a currency, commodity, commodity money or security for the purpose of determining the tax treatment of bitcoins and whether the SEC or CFTC would have any regulatory jurisdiction over them. Despite the absence of a formal classification of Bitcoin as an asset class, US federal regulators have initiated prosecutions for crimes in which bitcoins constituted a monetary denomination or a payment of money. The prosecutions in [FONT=Arial]SEC v. Trendon T. Shavers, et al. (for the operation of a Ponzi scheme denominated in bitcoins) and U.S. v. Ross William Ulbricht (for the operation of an online black market using bitcoins for payment) serve as high-profile examples.[/FONT]

Future Regulation

Although the existing regulatory landscape is characterized by substantial uncertainty, the Hearings reflected positively on the regulatory future of Bitcoin and digital assets. The panelists at the Hearings included Jennifer Shasky Calvery, the Director of FinCEN; Mythili Raman, the Acting Assistant Attorney General of the Criminal Division of the US Department of Justice; Edward Lowery, Special Agent in Charge of the Criminal Investigative Division of the US Secret Service; David Cotney, the Commissioner of Banks of the Massachusetts Division of Banks, as the representative for the Conference of State Bank Supervisors; and various industry participants such as the Bitcoin Foundation.

The panelists representing the various US regulatory and law enforcement agencies (the “Agency Panelists”) noted that digital assets present an additional challenge for law enforcement agencies that must develop and implement strategies to contend with illicit actors’ actual and possible use of the emerging technology. The Agency Panelists also consistently expressed the view that digital assets have legitimate and beneficial uses and should not be overburdened by regulation. Their testimony and prepared statements touched upon the following themes:

- Assistant Attorney General Raman emphasized that digital assets are not “in and of themselves illegal” and questions of legality arise due to illicit actors’ attempts to take advantage of the vulnerabilities of digital assets and their service providers.

- The Agency Panelists indicated that the current legal system does not pose an impediment to digital assets as long as their use and the services provided in connection therewith comply with existing laws such as the anti-money laundering and counter-terrorist financing requirements of the Bank Secrecy Act and the USA PATRIOT Act.

- Agency Panelists recognized that digital assets have many legitimate uses that have the potential to benefit society. Director Shasky noted in her prepared statement that several new payment systems “have proven their capacity to empower customers, encourage the development of innovative financial products, and expand access to financial services.” Director Shasky also noted that “cash is probably still the best medium for laundering money.”

- The Agency Panelists also were in agreement that existing federal regulatory structures are sufficient to address the use, and misuse, of digital assets, noting that current statutes are “broad enough” and “flexible enough” to address the use of digital assets for illicit purposes. The successful regulatory actions taken against e-Gold, a centralized digital currency backed by gold coins, and Liberty Reserve, a centralized, digital asset money transfer system—both of which were charged successfully with money laundering—were cited as positive examples. Director Shasky also noted that her experience with digital assets to date has indicated that the existing regulatory regime already constitutes a “strong platform” with which to address digital assets and is flexible enough to adapt to future changes.

- The Agency Panelists and Senators generally recognized the need to foster technological innovation, with Director Shasky stating that legislators and regulators should develop “smart regulation” that mitigates the risks of illicit activity while minimizing the burdens on law-abiding participants in the digital asset space. In this connection, some of the Agency Panelists identified the need for continued cooperation with industry participants that are willing to comply with applicable laws and regulations. These Agency Panelists expressed the desire that their respective agencies share information with and perform outreach to such industry participants to ensure that they develop adequate policies and procedures to satisfy, among other things, applicable anti-money laundering and counter-terrorist financing requirements. The August 2013 conference between representatives of the Bitcoin Foundation and various federal agencies was cited as an example of this regulatory outreach.

- Finally, of special note is that some of the panelists recognized the fact that Bitcoin differs from other digital assets with respect to the aversion that illicit actors apparently feel toward Bitcoin. According to Special Agent in Charge Lowery, the experiences of the US Secret Service in dealing with digital assets have revealed that illicit actors “have not by and large gravitated towards . . . peer-to-peer cryptocurrenc[ies]” such as Bitcoin but instead “have by and large gravitated towards centralized digital currenc[ies] that . . . [are] based in a locale that may have less regulatory guidelines and . . . less aggressive law enforcement.” Panelist Jerry Brito, a senior research fellow at the Mercatus Center at George Mason University, provided additional explanation, noting that illicit actors are attracted to centralized digital assets such as Liberty Reserve that are run by intermediaries willing to deceive regulators and were “designed and managed . . . to avoid know-your-customer and reporting rules and to evade subpoena.” In contrast, as Mr. Brito made clear, Bitcoin is a decentralized digital asset without such an intermediary and is less attractive to illicit actors because its protocol requires the recording of all transactions on a public ledger hosted on the Bitcoin Network.

Preparing for the Future

The Hearings reflect a positive but as yet undetermined regulatory future. As the regulation of Bitcoin and other digital assets continues to evolve, start-up enterprises, exchanges, service providers, and other industry participants engaged in or seeking to engage in the digital asset industry, or to utilize Bitcoin as a financial tool, must take precautions to ensure that they comply with applicable law. For its work on the Winklevoss Bitcoin Trust, Katten Muchin Rosenman LLP was recently commended by the [FONT=Arial]Financial Times as Lawyers to the Innovators 2013. Katten Muchin Rosenman LLP also advises entrepreneurs in creating new digital asset-related products and companies that are actively engaged in the digital asset ecosy[/FONT]

Oops

Bitcoin= $467

Ration Bit coin to CMI.

nov 29 2013 Bit .93:1 CMI

USD 1000.00:1

Dec 18 Bit 2.1:1 CMI

USD 1000.00: 1 CMI

Jan 1 2014 USD 2500.00:1 CMI

BIT ????: 1 CMI

My feeeling is the CMI corp will not take bit coins. Yes I know that Jan 2nd the USD could implode but most of the world will take that bet over the bit any day.

InterNACHI accepts bitcoins. The Master Inspector Certification Board does not.

http://www.mondaq.com/images/profile/company/1707.jpg

United States: Bitcoin: Current US Regulatory Developments

In recent months Bitcoin has become a hot topic in the financial, regulatory and legal community and has received widespread attention from newspapers such as The Wall Street Journal and The New York Times. Katten Muchin Rosenman LLP has been actively working on Bitcoin-related matters for the past year and has become a legal thought-leader in the area. As such, we would like to update our clients and friends on the current US regulatory developments regarding Bitcoin.

Bitcoin was introduced in 2009 and has produced a dynamic new economy composed of merchants, users, service providers and start-up enterprises. Over the past 12 months the value of bitcoins has appreciated by more than 6000 percent, and Bitcoin has achieved a current market capitalization of over $8 billion. In addition to gaining traction as a medium of exchange and a unit of account, Bitcoin has caught the attention of members of the financial industry, who are beginning to recognize Bitcoin for its potential as a short- and/or long-term investment opportunity. For example, the proposed Winklevoss Bitcoin Trust is designed to be the first exchange-traded fund product based in Bitcoin.1

Due to its potential to become a significant new financial payment mechanism, Bitcoin has attracted the attention of US federal and state—as well as international legislative and regulatory—bodies. On November 18 and 19, 2013, the US Senate Homeland Security and Governmental Affairs Committee and the Senate Banking Committee, respectively, held hearings (the “Hearings”) to discuss the risks and potential benefits of digital assets such as Bitcoin, which are also referred to as “virtual currencies.” Although the regulatory landscape surrounding digital assets has not been fully developed and is difficult to predict, the testimony provided at the Hearings reflected the following themes and suggested that US regulators do not intend to stifle digital assets:

- Digital assets have legitimate and beneficial uses that can foster innovation in a variety of ways, including micro-payments, enhanced security for retailers, and increased speed and cost efficiency in domestic and international payment systems.

- Existing federal laws, as well as law-enforcement, are capable of addressing the concerns relating to emerging digital assets, although developments are constantly being monitored in the areas of money laundering and other illicit uses.

- Various regulatory agencies have successfully applied the existing regulatory structure to prosecute large-scale money laundering operations that involved digital assets.

- Digital asset businesses and other industry participants that are willing to comply with applicable laws and regulations should be encouraged through a cooperative regulatory atmosphere. This sentiment was generally shared by the US Senators and panelists, in part to avoid discouraging Bitcoin entrepreneurship and driving it to countries with less stringent regulations.

Certain countries, including Germany and Canada, have emerged as “Bitcoin-friendly” jurisdictions through their favorable pronouncements regarding the regulation and treatment of Bitcoin. However, this advisory addresses the results of the Hearings and the current regulatory environment for Bitcoin under US federal and state laws.

Introduction to Bitcoin

Bitcoin is a type ofdigital asset which is based upon a peer-to-peer, decentralized computer-generated math-based and cryptographic protocol. Bitcoins may, among other things, be used to buy and sell goods or services, or as a unit of account.2 Bitcoins may be converted to fiat currency, such as US dollars or other national currencies based on then-current exchange rates.

Bitcoin shares certain characteristics with gold bullion in that each functions as a medium of exchange and is limited in supply (leading Bitcoin to be referred to as “Gold 2.0”). Approximately 12 million bitcoins currently exist and, based on the bitcoin formula, the maximum number of bitcoins that will ever exist is 21 million.

To date, no US legal body or regulator has officially determined that bitcoins are a currency, commodity, commodity money or security. However, as discussed below, the US Financial Crimes Enforcement Network (FinCEN), a bureau of the Department of the Treasury responsible for the federal regulation of currency market participants, has mandated that administrators and exchangers of all convertible digital assets, including Bitcoin, must register with FinCEN as money services businesses (MSBs) and comply with the requirements of both the Bank Secrecy Act of 1970 and the USA PATRIOT Act of 2001.

Digital assets, like Bitcoin, also provide a powerful financial tool for the transmission of money in both large and small quantities, in a domestic or international setting, for limited fees and with near real-time confirmation. Despite certain media representations to the contrary, the protocol and computer network that underlie Bitcoin (the “Bitcoin Network”) do not provide users with complete anonymity; rather, all Bitcoin transactions are recorded on the Bitcoin Network’s public ledger (known as the “Blockchain”), which is fully transparent. Bitcoin users are identified on the Blockchain by one or more pseudonyms in the form of “digital addresses,” of which a user may have many. Using existing technology and statistical analysis of the Blockchain, it is possible to track activity on the Bitcoin Network, thereby limiting the anonymity of Bitcoin users.

To date, Bitcoin is the most prominent digital asset with the largest user and merchant base and market capitalization. The technical features of Bitcoin that contributed to its relatively rapid adoption include:

- the Bitcoin Network’s open-source, decentralized nature and the capacity to quickly fix vulnerabilities or defects in the Bitcoin Network protocol through software updates;

- the Bitcoin Network’s cryptographically founded proof-of-work system that crowd-sources security and transaction verification to eliminate counterfeiting and prevent users from trying to repeatedly spend the same bitcoins (i.e., the “double spend” solution); and

- Bitcoin’s capacity to facilitate domestic and international transactions of any amount with minimal (or zero) transaction fees and near real-time transaction confirmation.

There are approximately 35 other digital assets being used today, many of which are based on protocols similar to or derived from Bitcoin. However, these “alt-coins” have achieved only a fraction of the market capitalization of Bitcoin in part due to Bitcoin’s status as a first mover in the digital asset space and the rapid, widespread adoption of Bitcoin due to its technological nature and minimal upfront costs.

Current State of Regulation

Money Service Business and Money Transmission Registration and Licensing

As of the time of this writing, FinCEN is the only US federal regulator to have released official guidance on the use of Bitcoin. In March 2013, FinCEN published interpretive guidance clarifying the application of the Bank Secrecy Act and the USA PATRIOT Act to Bitcoin and other convertible digital assets by stating that any administrator or exchanger of bitcoins (or other convertible digital asset) must be a registered MSB under FinCEN’s money transmitter regulations. The release indicated that individual users of bitcoins that are not operating a business would not be considered MSBs and therefore would not be required to register, report or perform recordkeeping. Such clarification also requires administrators or exchangers of bitcoins to comply with applicable state law and register with certain state regulatory agencies.

Furthermore, various state regulators, including the California Department of Financial Institutions, the Idaho Department of Financial Services and the New York Department of Financial Services, have followed FinCEN’s example and have issued interpretations or mandates requiring that Bitcoin exchanges and service providers register and/or seek licenses on a state level as money transmitters or MSBs.

Anti-Money Laundering and Other Requirements

Digital asset service providers that qualify as MSBs also are required to implement anti-money laundering, know-your-customer and financial information reporting policies and procedures in order to comply with various requirements under the Bank Secrecy Act and USA Patriot Act. Correspondingly, such service providers also may be subject to analogous requirements under similar state laws.

Absence of Clear Guidance

The absence of clear regulatory guidance concerning Bitcoin and other digital assets has generated substantial legal uncertainty for individuals and enterprises seeking to develop Bitcoin’s potential as a new financial tool. In May 2013, the General Accounting Office issued a report (the “GAO Report”) describing digital assets and urging the Internal Revenue Service (IRS) to issue guidance concerning the income tax treatment of digital assets (for example, whether gain from a sale of bitcoins is capital gain or ordinary income) under the Internal Revenue Code and the regulations thereunder. Thus far, the IRS has not issued any such guidance; however, at the Hearings, the Director of FinCEN indicated that the IRS was actively working on such guidance. Similarly, to date the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have not issued any guidance or interpretation concerning Bitcoin or any other digital asset.

The Federal Reserve System has indicated that it generally does not have the authority to regulate Bitcoin and other digital assets as they currently operate. Specifically, Federal Reserve System Chairman Ben Bernanke, in a statement submitted for one of the Hearings, stated that, in general, the Federal Reserve System “would only have authority to regulate a virtual currency product if it is issued by, or cleared or settled through, a banking organization that we supervise.” The Federal Reserve System does not have the authority to regulate Bitcoin because bitcoins are issued by and settled through the Bitcoin Network.

This lack of clear guidance has impacted the development of Bitcoin and other digital assets in the United States. In particular, uncertainty regarding Bitcoin’s legal classification and the MSB and money transmitter regulation of Bitcoin-related entities has resulted in a tenuous relationship between banking institutions and the Bitcoin economy, including start-up Bitcoin service providers. Clear guidance from federal and state regulators can lead to more certainty for both the banking and Bitcoin communities.

Legal Classification as an Asset

A fundamental question that remains unanswered is the legal classification of bitcoins for regulatory purposes. US federal regulators are aware that the asset classification of bitcoins is a central issue. The GAO Report did not formally classify bitcoins, but described them as akin to virtual property.

Therefore, the few findings in court cases and regulatory opinions involving the use of bitcoins vary in their determination of asset classification depending on the regulatory context. For example, the Federal Election Commission (FEC) and the Magistrate Judge in SEC v. Trendon T. Shavers, et al. recently issued differing views on the possible legal classification of bitcoins. The FEC earlier this month proposed, but did not approve, a draft advisory opinion that would have permitted the use of bitcoins for in-kind contributions under the regulatory category of “anything of value,” which includes commodities, stock and equipment. The draft advisory opinion, noting the more narrow regulatory definition of “money” under election law, stated that bitcoins could not be accepted as a money contribution and would have to be converted to US dollars for deposit in a campaign account. In contrast, the Magistrate Judge stated that bitcoins “can be used as money” and possess attributes of a “currency or form of money.”

Currently no official guidance or determination exists from any US federal regulator that establishes whether bitcoins are a currency, commodity, commodity money or security for the purpose of determining the tax treatment of bitcoins and whether the SEC or CFTC would have any regulatory jurisdiction over them. Despite the absence of a formal classification of Bitcoin as an asset class, US federal regulators have initiated prosecutions for crimes in which bitcoins constituted a monetary denomination or a payment of money. The prosecutions in SEC v. Trendon T. Shavers, et al. (for the operation of a Ponzi scheme denominated in bitcoins) and U.S. v. Ross William Ulbricht (for the operation of an online black market using bitcoins for payment) serve as high-profile examples.

Future Regulation

Although the existing regulatory landscape is characterized by substantial uncertainty, the Hearings reflected positively on the regulatory future of Bitcoin and digital assets. The panelists at the Hearings included Jennifer Shasky Calvery, the Director of FinCEN; Mythili Raman, the Acting Assistant Attorney General of the Criminal Division of the US Department of Justice; Edward Lowery, Special Agent in Charge of the Criminal Investigative Division of the US Secret Service; David Cotney, the Commissioner of Banks of the Massachusetts Division of Banks, as the representative for the Conference of State Bank Supervisors; and various industry participants such as the Bitcoin Foundation.

The panelists representing the various US regulatory and law enforcement agencies (the “Agency Panelists”) noted that digital assets present an additional challenge for law enforcement agencies that must develop and implement strategies to contend with illicit actors’ actual and possible use of the emerging technology. The Agency Panelists also consistently expressed the view that digital assets have legitimate and beneficial uses and should not be overburdened by regulation. Their testimony and prepared statements touched upon the following themes:

- Assistant Attorney General Raman emphasized that digital assets are not “in and of themselves illegal” and questions of legality arise due to illicit actors’ attempts to take advantage of the vulnerabilities of digital assets and their service providers.

- The Agency Panelists indicated that the current legal system does not pose an impediment to digital assets as long as their use and the services provided in connection therewith comply with existing laws such as the anti-money laundering and counter-terrorist financing requirements of the Bank Secrecy Act and the USA PATRIOT Act.

- Agency Panelists recognized that digital assets have many legitimate uses that have the potential to benefit society. Director Shasky noted in her prepared statement that several new payment systems “have proven their capacity to empower customers, encourage the development of innovative financial products, and expand access to financial services.” Director Shasky also noted that “cash is probably still the best medium for laundering money.”

- The Agency Panelists also were in agreement that existing federal regulatory structures are sufficient to address the use, and misuse, of digital assets, noting that current statutes are “broad enough” and “flexible enough” to address the use of digital assets for illicit purposes. The successful regulatory actions taken against e-Gold, a centralized digital currency backed by gold coins, and Liberty Reserve, a centralized, digital asset money transfer system—both of which were charged successfully with money laundering—were cited as positive examples. Director Shasky also noted that her experience with digital assets to date has indicated that the existing regulatory regime already constitutes a “strong platform” with which to address digital assets and is flexible enough to adapt to future changes.

- The Agency Panelists and Senators generally recognized the need to foster technological innovation, with Director Shasky stating that legislators and regulators should develop “smart regulation” that mitigates the risks of illicit activity while minimizing the burdens on law-abiding participants in the digital asset space. In this connection, some of the Agency Panelists identified the need for continued cooperation with industry participants that are willing to comply with applicable laws and regulations. These Agency Panelists expressed the desire that their respective agencies share information with and perform outreach to such industry participants to ensure that they develop adequate policies and procedures to satisfy, among other things, applicable anti-money laundering and counter-terrorist financing requirements. The August 2013 conference between representatives of the Bitcoin Foundation and various federal agencies was cited as an example of this regulatory outreach.

- Finally, of special note is that some of the panelists recognized the fact that Bitcoin differs from other digital assets with respect to the aversion that illicit actors apparently feel toward Bitcoin. According to Special Agent in Charge Lowery, the experiences of the US Secret Service in dealing with digital assets have revealed that illicit actors “have not by and large gravitated towards . . . peer-to-peer cryptocurrenc[ies]” such as Bitcoin but instead “have by and large gravitated towards centralized digital currenc[ies] that . . . [are] based in a locale that may have less regulatory guidelines and . . . less aggressive law enforcement.” Panelist Jerry Brito, a senior research fellow at the Mercatus Center at George Mason University, provided additional explanation, noting that illicit actors are attracted to centralized digital assets such as Liberty Reserve that are run by intermediaries willing to deceive regulators and were “designed and managed . . . to avoid know-your-customer and reporting rules and to evade subpoena.” In contrast, as Mr. Brito made clear, Bitcoin is a decentralized digital asset without such an intermediary and is less attractive to illicit actors because its protocol requires the recording of all transactions on a public ledger hosted on the Bitcoin Network.

Preparing for the Future

The Hearings reflect a positive but as yet undetermined regulatory future. As the regulation of Bitcoin and other digital assets continues to evolve, start-up enterprises, exchanges, service providers, and other industry participants engaged in or seeking to engage in the digital asset industry, or to utilize Bitcoin as a financial tool, must take precautions to ensure that they comply with applicable law. For its work on the Winklevoss Bitcoin Trust, Katten Muchin Rosenman LLP was recently commended by the Financial Times as Lawyers to the Innovators 2013. Katten Muchin Rosenman LLP also advises entrepreneurs in creating new digital asset-related products and companies that are actively engaged in the digital asset ecosystem.

Footnotes

1 Katten Muchin Rosenman LLP serves as counsel to the Winklevoss Bitcoin Trust.

2 There is little precedent for the classification of bitcoins as a currency, commodity, commodity money or security. For ease of reference, however, this advisory uses the term “digital asset” to encompass Bitcoin and other digital assets (whether centralized or decentralized), known as “alt-coins.”

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances. a Question or Comment?

](http://www.mondaq.com/content/contact.asp?article_id=277850&author_id=922924&type=articleauthor)

Bitcoin is off 50% from its high 10 days ago.

Some store of value :sarcasm:

U.S. dollar is off 97% from it’s high in purchasing power 100 years ago. The U.S. dollar is definitely not a store of value. Someone tell the Chinese and those who have savings accounts please.

Gold (fools) plummetsto it’s largest decline in 13 years. Wait about another year and you’ll be able to buy at $600/oz.

Pricing digital gold (I only buy old, physical) in a devaluing paper currency means what in terms of wealth preservation? Gold hasn’t lost its purchasing power in over 6,000 years. Today, 60 centuries later, a physical ounce can still be traded for about 300 loaves of bread.

In comparison, the U.S. dollar (the currency your link is pricing digital gold in) has only been around one century and has already lost 97%-99% of its purchasing power. So if you are looking for a store of wealth, you should look to trade your paper dollars for physical gold.

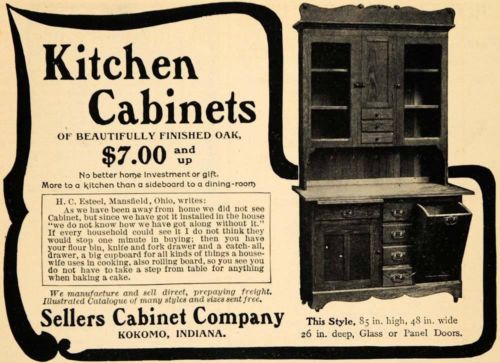

Here’s a 100-year old ad for a kitchen (I actually own this piece, it’s in my garage). They sell used on craigslist for $700.00 and up. Take a peek (PIC attached) at the price it sold for back then.

Gold’s price in paper is volatile (so you can always find days, months and years when it goes up and down in paper). In comparison though, the U.S. dollar’s purchasing power is steady… steadily going down LOL. If your distaste for volatility outweighs your taste for steady decline, disregard this post.

10 days Nick. 10 days.

Exactly.

Gold has been used as money for 6,000 years and has maintained its purchasing power over its entire life.

U.S. dollar has been used as money for 100 years and has lost 99% of its purchasing power over its life (see attached PIC in post #57).

10 days? I can show you more 10-day periods where bitcoins and gold have gone up in numbers of dollars required to buy them, than down. Might as well count the number of 10-minute segments of time where they went up and compare them to 10-minute segments of time where they went down vs. paper. And even if you could time those 10-minute or 10-day rallies and declines, you can’t day trade physical gold anyway. It’s like that 100-year old kitchen in my garage.