There’s your state of the union.

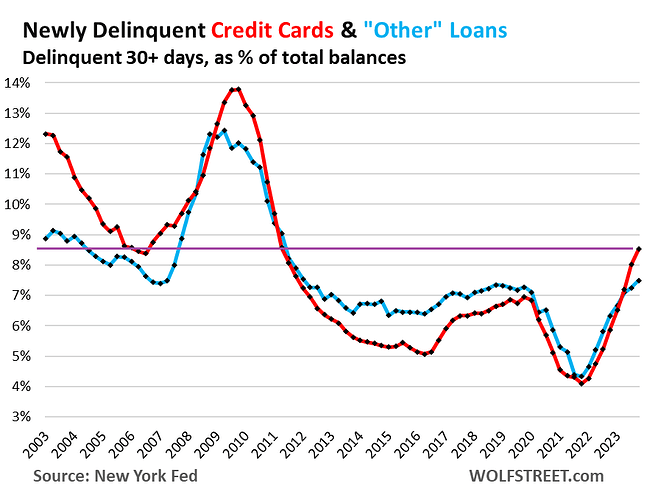

So how does that compare to the OP title? The graph shows “Newly Delinquent,” whish is a subset of the total. It also shows 30+ days delinquent as % of total balances. The FED typically tracks delinquencies as 60+ or 120+. What point are you making?

That Americans as a whole, but especially young people, have had poor credit card management skills for quite some time.

Thank you Captain Obvious!

Ryan is going to defend today’s economy because he thinks people are not really hurting but rather a political narrative. He has the charts to prove it. And when they tell a different story, he finds another point in history.

Right now the trend is bad and it is moving towards recession numbers. I hope it does not get there.

See that big dip after 2008? That is when the banks clamped down on lending to irresponsible borrowers. But alas, eventually the banks and their shareholders become greedy again. One thing is for certain, if you extend ever increasing amounts of credit to irresponsible people, they will take advantage of it. The banks know this and they prey on these people.

As inspectors we see this in action every now and again. The caller who is purchasing a home but who says they can’t swing $400-$500 for an inspection. Makes one wonder, doesn’t it? ![]()

His charts are always a “straw man” argument.

So, is this “clamping down” something we can track? Or are we just assuming the banks have loosened their credit restrictions?

Also, my understanding is that the higher the risk, the higher the interest rate. Does that attract borrowers or deter them?

Do we know the average credit score of these delinquent borrowers? Has something changed in their life that may have caused them to rely on credit?

What are the demographic comparisons? Or are these all just new, irresponsible young people?

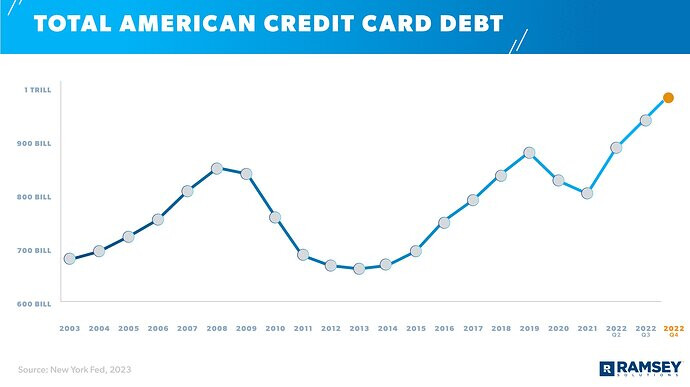

Yes, and that doesn’t change the fact that total American credit card debt is at an all time high.

It does! People are buying above what they can truly afford. Consequently, the cash needed to purchase has maxed out their savings. Any spending above that becomes very painful.

My niece and her husband both work and have two children. Their lease is up in July. They must buy or move away from school, church, and family. There is nothing in the area below $400k. Therefore, cash is a premium for them right now. She is not sure she can pull it off, we’ll see. If not, she moves 1.5 hours away from her job.

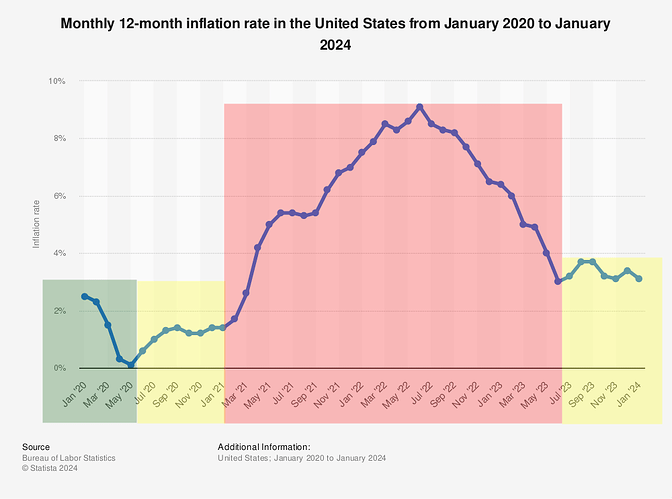

Yes, our country has high credit card debt and delinquencies, we’re still dealing with inflation after covid, but it’s gone from 9 percent to 3 percent over a 2 year period, and we have high interest rates, which were raised to bring inflation under control, which hopefully will soon be coming back down as well.

But the fact is, our economy is still by far the strongest, most stable on the planet and continues to get stronger!!

My gosh. Almost every sentence in your post is a question, lol. I do have other things to get done today.

Oh gosh, it must be time to become sarcastic.

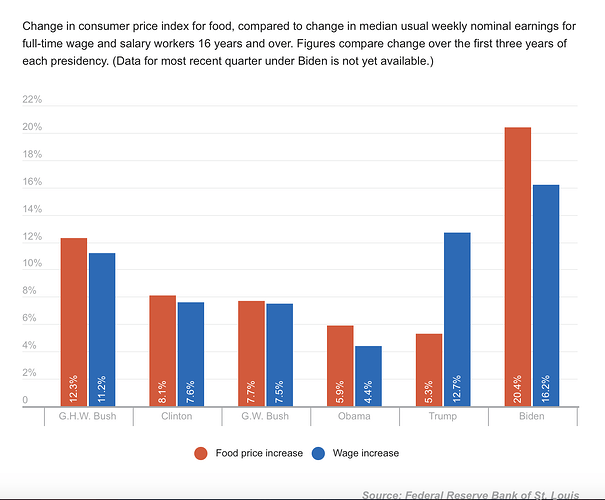

Here is another way to look at inflation. I am happy to see it going down, but it comes at a high price. My point is, a 20% increase in cost for consumers over 4 years hurts pretty damn bad.

A 3.1% inflation rate may not seem like a lot, or as much as the price changes you’ve noticed at the grocery store. To put inflation in context over the last few years, consumer price inflation rose 19.6% between January 2020 and January 2024, and particularly high housing costs persist.