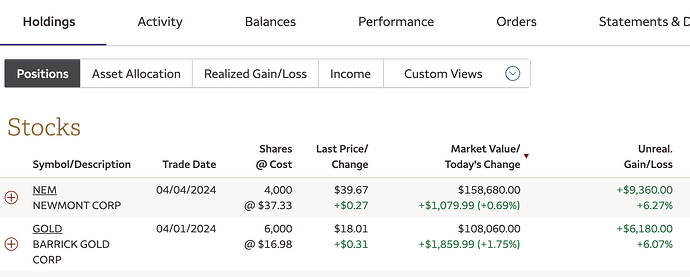

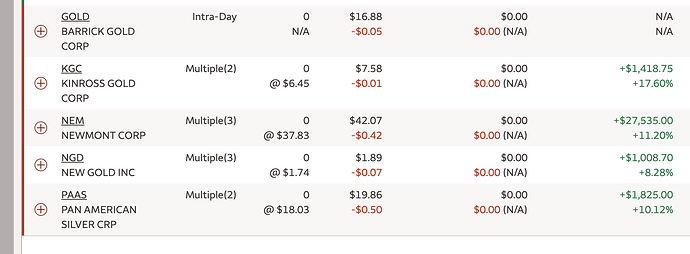

Basically, a gold play.

In the year-to-date period, GLD achieves a 6.24% return, which is significantly lower than SPY’s 10.41% return. Over the past 10 years, GLD has underperformed SPY with an annualized return of 5.02%, while SPY has yielded a comparatively higher 12.96% annualized return. The chart below displays the growth of a $10,000 investment in both assets, with all prices adjusted for splits and dividends.

The chart in front of us suggest that GLD has work to do verses the broader market, good luck on your trade. Personally I’m still looking at a position is small caps but the picture is still fuzzy and I’m willing to wait for more favorable conditions.