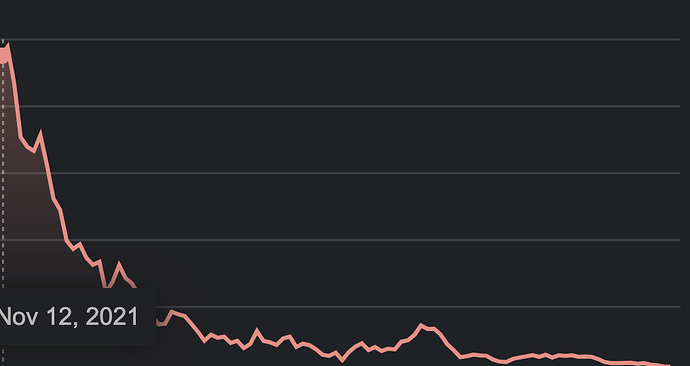

Their market cap is down to $51 million.

I have a standing sell order in on my shares for $1.50, if you’re interested. ![]()

They are sitting on too much cash to go bankrupt.

What would we do with it, if InterNACHI bought it? Only part I’d want is HIP.

Just curious, I don’t own any Porch but what product does Porch sell? I’ve heard about data collection, if that’s the case who buys it?

That aside, an in house software and scheduling solution with solid products like HIP etc., makes Nachi harder to beat than they already are.

ISN without the fear of your client data being stolen is nice as well.

In a nutshell, they started out as a home services leads broker, but then purchased a bunch of different companies and have attempted to “integrate” all of those together in one form or another. For instance, using their home inspection data to price their (and others) insurance products and to sell their warranties and contractor services.

You could buy, keep the pieces you want, and sell-off the rest. Please note that InterNACHI has benefitted from being largely vendor-neutral in terms of software and service providers. If you align with a particular software or services, that may cause unwanted friction with existing partners.

I know. That’s a problem.

Easier to buy a disgruntled software partner than to purchase Porch, no? ![]()

Why is it a problem? If you no longer need a vendor, so be it. Do they pay NACHI for access to its members for marketing purposes? Who’s toes will be stepped on that a NACHI member cannot live without?

Even if you own and offer ISN and HIP, it is not compulsory for a member to use those services.

They sell leads to contractors.

Instead of paying home inspectors for them, however, they actually charge home inspectors to provide them with leads. Pretty neat gimmick, if you ask me.

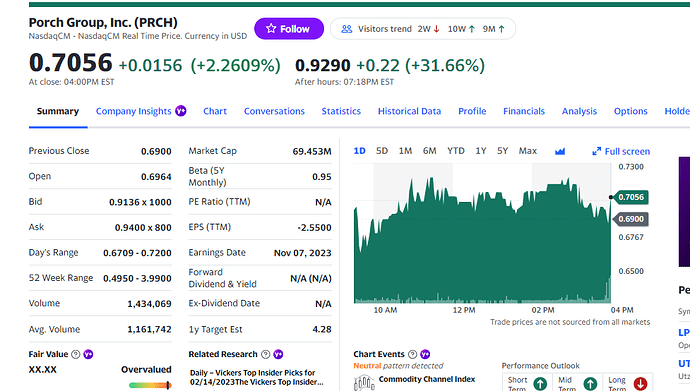

Good. Investor call coming up this month.

Big pop after hours. Earnings release was today after close. I haven’t read it yet but my guess is they surprised on earnings.

Their legal troubles are mostly over, as well.

A rising tide lifts all boats or maybe a short-squeeze spike it was oversold after all. ![]()

They upped guidance as well. I think I will raise my sell limit tomorrow. I’ve held longer than intended already anyway. Might as well see how this shakes out mid-range.

I have one big position at .80 and I’ll sell at $3.